For decades, veterinary practices that want to provide a better service backed by top-of-the-range diagnostic equipment have often had to ‘make do and mend’ with the cast-offs of human hospitals. That often means clunky or redundant technology and problems accessing support when things go wrong. But now a veterinary MRI company has come up with a new model for financing that could deliver a way forward. Cracking this particular conundrum will allow practices not just to gain access to high performance, up to date equipment but also veterinary specific technology. Could the model be applied elsewhere and just what could that do for the profession?

When Hallmarq Veterinary Imaging was awarded a Queen’s Award for Enterprise this year it wasn’t just for the company’s innovation in equine standing MRI – an innovation that has actually revolutionised the veterinary approach to lameness. Another significant contributor to the decision to make the award was in recognition of the financial model that made MRI an affordable option for vets. That model has now been applied in the companion animal field with the Hallmarq PetVet 1.5 Tesla MRI.

While no one is suggesting that this opens up the opportunity for every practice, a few practices have now opened their eyes to the possibility of having an in-house MRI system, where before that door was firmly closed. There are three central financial concepts that allow Hallmarq to make MRI affordable and those considerations have been paramount in the design of their veterinary specific MRI: namely cost reduction, cash flow management and return on investment.

Cost reduction

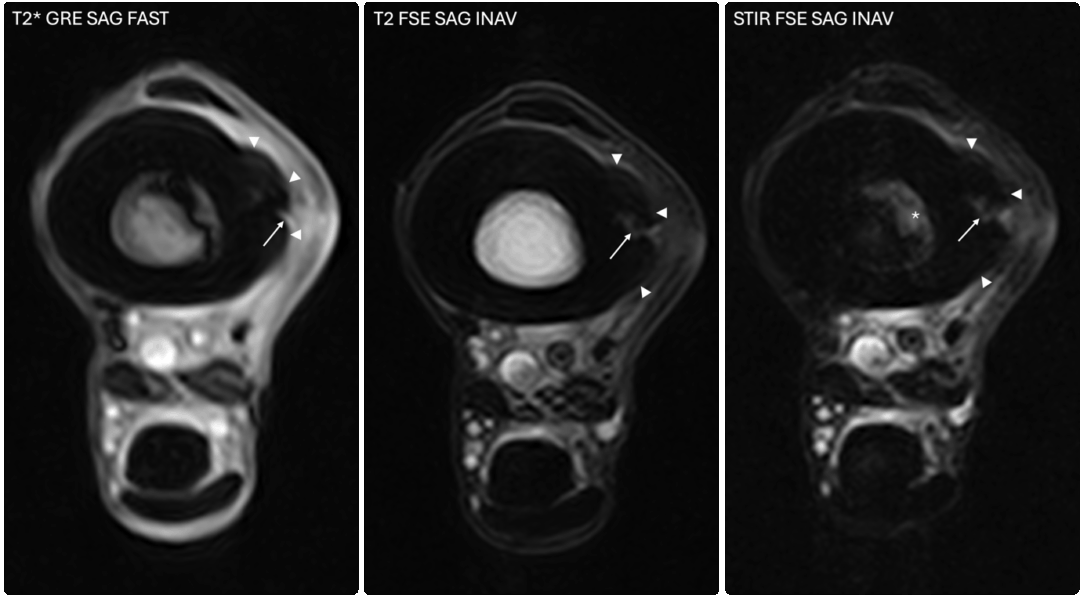

Reducing cost while not compromising on quality was a big challenge in the design of the PetVet. The machine has in-built RF shielding meaning that about £125,000 is immediately removed from the cost of installation – there’s no need for an RF shielded room. Conservation of helium – not only a cost but a rare resource – means that routine refills are not required. Dual coils were manufactured for a prototype using 3D printing and improve imaging of difficult to view structures like the brachial plexus.

These innovations strip cost out of the MRI allowing it to be produced, installed and maintained at a better cost point. .By thinking about cost as integral to design as other desirable features, a better result is achieved and this is a lesson for anyone seeking to make a standard piece of high tech more attractive to practices.

Cash flow management

As barriers to entry go, a million pounds worth of MRI is pretty significant so with the old financial model only a few referral practices would be likely to have this equipment. But with the Hallmarq PetVet MRI only the cost of installation needs to be found – or less than 10% of the overall cost. This gives practices working with Hallmarq MRI a competitive advantage and opens up the opportunity to newly established and smaller referral practices, as well as larger operations.

Any practice owners who have gone cap in hand to their bank managers and asked for a loan recently might want to imagine how they would be responded to if they made a request for a million pounds. Jumping through financial hoops would be the least of it. In contrast, a more affordable sum might even be found from retained profit, reducing the time, resources and sheer stress involved in seeking an elusive bank loan and the interest it accumulates. It’s also a lesser amount of cash tied up in the asset, enabling the practice to be more creative in marketing and promotion so that it is fully utilised.

Return on Investment

That brings us very nicely on to the topic of return on investment. Over and above the installation costs, Hallmarq Veterinary Imaging’s MRI uses a pay-as-you-go model which means the practice “rents” the MRI and pays for technical support and maintenance. With PetVet supported by science graduates in the London, Boston and Sydney offices, most of this can be done remotely – keeping costs down still further. Taking into account all of these costs including installation, in the “average” clinic the break-even point when costs are covered is reached at five to nine cases per month. Every case above that generates profit contribution for the hospital.

At its heart, the model rests on the fact that MRI in the right hands is profitable.

This of course, only takes into account direct revenue from charges made for the scan itself. Many referral practices will be looking to treat the condition identified and arguably, in some instances that case would only have been referred because of the MRI facility. Hallmarq also offers new MRI practices a traffic driving support package to help them drive awareness in referring veterinarians and communities.

Other intangibles that remain difficult to put an exact economic value on include the ability to attract more highly qualified individuals to work in the facility. 24-7 access to MRI ensures all patients benefit from the highest quality diagnostics and this has reputational benefits – MRI is widely recognised by clients as an impressive piece of kit and a visible sign of expertise.

Way to go?

The possibility remains that Hallmarq could be the trailblazer for a new way to finance projects in the veterinary sector that once would have required a high level of capital investment. For referral practices, in particular, this offers an opportunity to strengthen their position and expertise. Hallmarq Veterinary Imaging’s sights remain very firmly on diagnostic imaging– an area in which acquiring its level of expertise is no mean feat. So, it’s down to other companies to look at what has been achieved and to determine if clever thinking about financial models opens up, even more, possibilities in veterinary practice

Hallmarq CEO, vet Jos Belgrave, says it’s all about novel thinking, “We identified a problem – the risks posed by equine anaesthesia and the opportunity offered by diagnostics – and found a way round it with equine standing MRI. With the companion animal unit, there was a need for affordable, high quality, high field MRI suitable for veterinary patients – the same type of scenario. Problem-opportunity-need – if I had to sum up what’s at the core of our business in three words, you have it right there. We apply the same thinking to our financial models as we do to technical innovation in MRI. It works.”

Previously published in Veterinary Practice